city of mobile al sales tax application

Additionally the business owner needs to possess a Certificate of Occupancy for the. Get rates tables What is the sales tax rate in Mobile Alabama.

Home Prattville Alabama Prattvilleal Gov Official Site Of The City Of Prattville

Apply for a Mobile.

. In mobile or our downtown mobile office at 151 government st. The December 2020 total local sales tax rate was also. ONE SPOT provides a single point of filing for all state-administered local sales use rental and lodgings taxes as well as non-state administered sales use and rental taxes.

This is the total of state county and city sales tax. In Mobile or our Downtown Mobile office at 151 Government St. Application Authorization Certificate of Good Standing Request Corporate Officer Change.

Lodgings alcohol occupational tobacco. Monday through Friday 8am-5pm. The minimum combined 2022 sales tax rate for Mobile Alabama is 10.

City Ordinance 34-033 passed by the City Council on June 24 2003 went into effect October 1 2003. Sales Tax If you are unable to fill out these forms please install Adobe Acrobat Reader here. Business license tax filing frequency.

Mobile AL Sales Tax Rate Mobile AL Sales Tax Rate The current total local sales tax rate in Mobile AL is 10000. Application for Sales Tax Certificate of Exemption ST. Laurel Avenue Foley AL 36535.

Complete this form to receive legal authorization to operate your business within Montgomery. The sales tax discount consists of 5 on the first 100 of tax due and 2 of all tax over 100. Effective March 1 2021 the City of Foley will begin.

Sales and Use taxes have replaced the decades old Gross Receipts tax. An Alabama Sales Tax Certificate of Exemption shall be used by persons firms or corporations coming under the provi-. Apply for a Mobile County Tax Account at our Michael Square Office at 3925-F Michael Blvd.

In Mobile Downtown office is. City of Mobile Alcoholic Beverage Application Business License Application Seller Use Tax Tax Form 13 Sales Tax Form 12 Petition for Release of Penalty Leasing Tax Form 3 Joint. In Mobile Downtown office is open on Monday and Friday only.

The sales tax discount consists of 5 on the first 100 of tax due and 2 of all tax over 100 not to exceed 40000. Salessellers use consumer use. Box 1750 Foley AL 36536.

Mobile Alabama 1960s Postcard Albert Pick Motel Artist Rendering Ebay

5 States Without Sales Tax And What To Know About Them

Wyoming Alaska And S Dakota Top Tax Friendly Business State List

Job Opportunities City Of Seattle

Sales Taxes In The United States Wikipedia

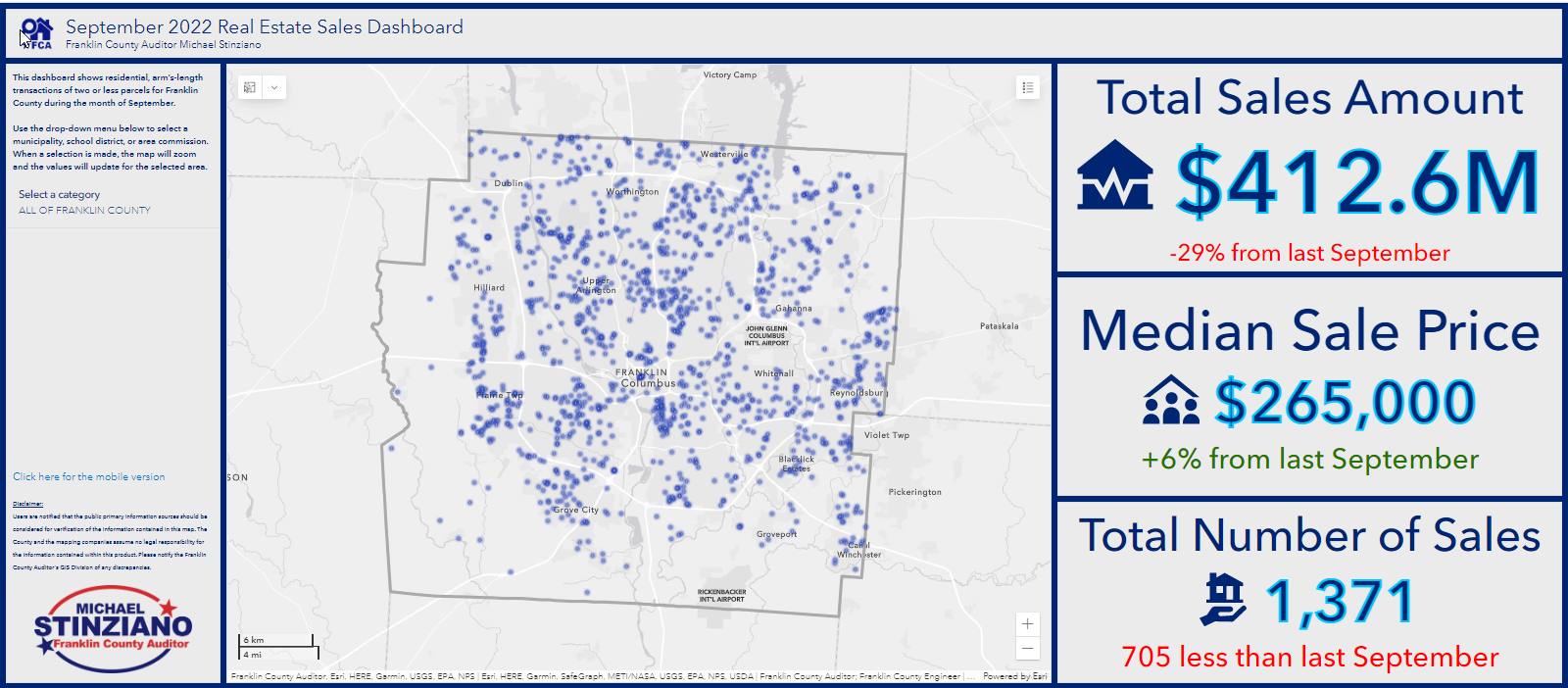

Sales And Use Alabama Department Of Revenue

How To Charge Sales Tax In The Us A Simple Guide For 2022

Application For Sales Tax Certificate Of Exemption Alabama

Sales Use Tax South Dakota Department Of Revenue

Colorado Sales Tax Withholding Account Application Cr0100 Fill Out Sign Online Dochub

Port Of Mobile Alabama Port Authority

Cities With The Lowest Tax Rates Turbotax Tax Tips Videos

City Of Mobile Business License Renewal Fill Online Printable Fillable Blank Pdffiller

Cdtfa Mobile California State Geoportal

Licenses And Taxes City Of Mobile

Sales Taxes In The United States Wikipedia

Form St Ex A3 Fillable Application For State Utility Mobile Communication Services Tax Certificate Of Exemption And Instructions